Taking a look at what we see and hear across the country, and mixing in the data from our survey, here’s where we found the latest trends for 2021:

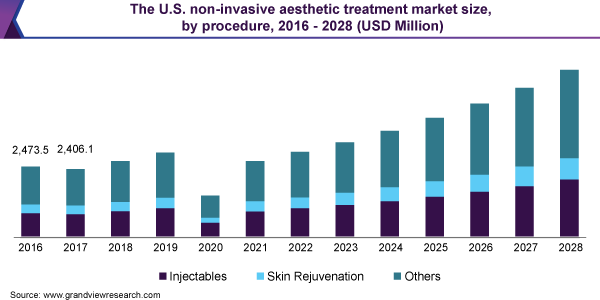

The global non-invasive aesthetic treatment market size was valued at USD 4.6 billion in 2020 and is expected to grow at a compound annual growth rate (CAGR) of 13.9% from 2021 to 2028. The market growth is attributed to the rising demand for fillers and injectables including Botox as a result of the increasing target population across the globe. According to the American Society for Aesthetic Plastic Surgery (ASAPS), in 2018, around 3.8 million minimally invasive cosmetic surgeries were carried out in the U.S. within the age group of 55 and above. This highlights high growth prospects for the market in the country. According to the International Society of Aesthetic Plastic Surgery (ISAPS), the U.S. was ranked first in terms of non-surgical procedures performed at a global level. Spas began to reopen across the US in the second half of the year, clients were flocking in. Worries that consumers would be fearful of human touch were unfounded. In fact, it was quite the opposite. The tolls of social distancing, working from home, and widespread lockdowns created a strong desire for human connection that spas were happy to accommodate. Despite curbside check-ins, temperature-taking, mask-wearing, and waiver requirements, clients filled the books of available treatments.

Sixty percent of those who are more focused on wellness now say the pandemic has made them realize they need to be healthier to withstand disease or illness. Specific procedures we see to increase are lymphatic drainage treatments, infrared saunas and contrast therapy, acupuncture, massage, the use of aromatherapy, and Products that promote gut health and support the microbiome will also be of major interest. Much of this is not necessarily new, but the effects of these treatments will be more sought after than was the case pre COVID since it creates stimulation and better overall fora healthy body.

“Men and women are becoming more sophisticated in their understanding of what can be achieved with their skin-care products and how to shop for the products with the best ingredients for them. Along with that knowledge, we are seeing a greater interest in procedures to improve skin texture and tone. Hybrid fractional laser resurfacing procedures such as Halo are a popular request because they work and the downtime is minimal. There is a greater acceptance in taking care of oneself and feeling better.” Chatham, NJ oculoplastic surgeon Baljeet Purewal, MD “The next generation of hyaluronic acid fillers , called Resilient Hyaluronic Acid or RHA, have arrived from Switzerland. Touted as the least-modified filler most similar to the body’s own hyaluronic acid (HA) the new product lines treat all dynamic facial wrinkles from the cheeks to the lips with longer-chain HAs for a more natural appearance. Secondly, the coming launch of DAXI, a new neurotoxin that purportedly will last for six months, will be a game changer for patients seeking smoother skin and reduced wrinkles with fewer trips to their certified injector.” Kirkland, WA facial plastic surgeon Daniel J. Liebertz, MD “I expect fillers and neurotoxins to continue being the most popular treatments. However, I think masks will be part of our life through next year. As such, everyone is more closely scrutinizing their eyes, and I believe treatments for eyelid and brow rejuvenation will continue trending up next year.” New York facial plastic surgeon Edward S. Kwak, MD “Clearly botulinum toxin and HA fillers will not be going away and will continue to hold the top spots. Nonablative lasers and chemical peels are also popular; however, these procedures are also becoming more popular in my office, and I anticipate we will see growth in them in 2021: (newbeauty.com)

1. Memberships

For those spending more time on wellness, the number one reason is to reduce stress- for both the client and YOU! Subscription and Membership-based business models continue to show strength, and for many spas, provided a much-needed lifeline of cash flow through the summer. Offering a wellness membership with access to amenities will be very popular in 2021, but don’t overlook the basic monthly massage, body treatment, and/or facial options, perhaps with the added bonus of products for home-use.

Many companies are continuing to have staff work from home for the immediate future. During this pandemic, we’ve seen how important it is to feel connected with colleagues. Spas and hospitality venues could find a niche in hosting small spa retreats, especially those that combine a bit of work with some wellness-building activities. The majority of Americans believe that wellness brings people together; what better way for co-workers to spend quality time together than at a spa?

Procedures:

As mask-wearing will continue for the time being, a focus on overall skin health and “above-the-mask” treatments will be of interest to your guests. Healthy, glowing skin from exfoliants, peels, LED and microcurrent treatments, beautifully groomed brows, and lash extensions help clients to feel more attractive as we stare at ourselves all day on Zoom calls.

“Who knows how long masks will be part of our daily ensemble,” says Dara Liotta, MD , a double board certified facial plastic and reconstructive surgeon in New York City. She predicts patients will choose to combine “minor eye-optimizing surgeries” that “provide natural-looking, permanent results” (think: (aedit.com)

Just because eyes are having a moment doesn’t mean lips are a thing of the past. 2020 saw the release of Restylane® Kysse , a hyaluronic acid-based lip filler from Galderma, and Dr. Liotta expects non-surgical pout procedures to continue to be in demand. “Lips are always ‘in’ and more and more patients are willing to pay a bit more for a perfect, couture, natural-looking lip,” Dr. Liotta says. Despite the popularity, lips can be a complicated area of the face to treat. “When you really analyze the lips, they’re composed of a number of different parts,” she explains. There are the philtral columns (the lines from the peak of the cupid’s bow up toward the nose), the cupid’s bow, the vermillion border (i.e. where you’d apply lip liner), and the body of the lip itself (where you’d put lipstick). “If you feel your own lips, you’ll appreciate that each of these areas have different stiffnesses, and move differently,” Dr. Liotta says. (aedit.com)

Trials and tribulations have minted a whole new group of teeth grinders and jaw clinchers, Dr. Liotta says. “2021 is going to be about mixing wellness and beauty,” she notes, and masseter Botox® is a great example of this. The masseter muscle is one of the muscles activated during chewing, and it’s located at the angle of the mandible (jaw). “In people who grind or clench their teeth, it’s extra tension in this muscle that’s the culprit,” Dr. Liotta explains. She says that Botox® can be used both functionally to weaken the masseter muscle (the main teeth-grinding muscle) and improve the pain of TMJ from teeth grinding and cosmetically to thin and soften the jaw from a hypertrophied (or overgrown) masseter muscle. “When Botox® is used to relieve the pain of TMJ and tooth-grinding, patients can expect some pain relief in as little as one to two weeks,” Dr. Liotta says. When Botox® is used to reduce masseter muscle hypertrophy cosmetically, the maximum effect is not seen for six to eight weeks, she adds.(aedit.com)

Overall, you can see,from the chart below it’s going to be a very prosperous couple of years for cosmetic surgery centers!

| Report Attribute | Details |

| Market size value in 2021 | USD 8.45 billion |

| Revenue forecast in 2028 | USD 18.5 billion |

| Growth Rate | CAGR of 13.9% from 2021 to 2028 |

| Base year for estimation | 2020 |

| Historical data | 2016 – 2019 |

| Forecast period | 2021 – 2028 |

| Quantitative units | Revenue in USD million/billion and CAGR from 2021 to 2028 |

| Report coverage | Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Segments covered | Procedure, region |

| Regional scope | North America; Europe; Asia Pacific; Latin America; MEA |

| Country scope | U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Norway; Sweden; China; Japan; India; South Korea; Thailand; Brazil; Mexico; Argentina; Colombia; South Africa; Saudi Arabia; UAE |

| Key companies profiled | Hologic, Inc.; Allergan, Inc.; Galderma S.A.; Alma Lasers; Syneron Candela; Johnson & Johnson; Merz Pharma; Lumenis; Solta Medical; Cutera, Inc.; Revance Therapeutics, Inc. |

| Customization scope | Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |